Ambulatory Surgery Centers Market Growth

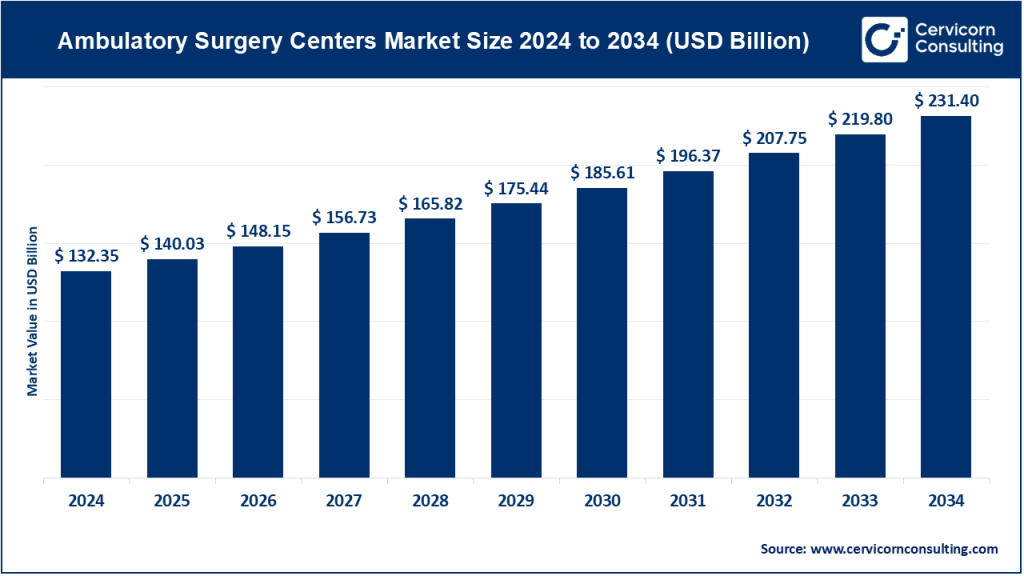

The global ambulatory surgery centers market was valued at USD 132.35 billion in 2024 and is projected to grow to approximately USD 231.40 billion by 2034, with a compound annual growth rate (CAGR) of 5.79% from 2025 to 2034.

The ambulatory surgery centers markets growth is driven by multiple factors, including the increasing prevalence of chronic diseases, technological advancements in minimally invasive surgeries, rising healthcare costs, and the shift toward value-based care. The aging global population and a surge in outpatient surgical procedures further fuel the demand for ASCs. Favorable government initiatives, such as reimbursement policies and regulatory support, also play a critical role in propelling market expansion.

What is the Ambulatory Surgery Centers Market?

The ambulatory surgery centers (ASCs) market comprises healthcare facilities that provide same-day surgical care, diagnostic, and preventive procedures. Unlike traditional hospitals, ASCs specialize in outpatient services, allowing patients to undergo surgeries or treatments and return home on the same day. These centers cater to various medical specialties, including orthopedics, ophthalmology, gastroenterology, and urology, and are equipped with state-of-the-art medical technologies.

Why is the Ambulatory Surgery Centers Market Important?

The importance of the ASC market lies in its ability to deliver high-quality healthcare services at reduced costs. ASCs offer an efficient alternative to inpatient hospital care, minimizing hospital stays and associated expenses. They enhance patient convenience, reduce the risk of hospital-acquired infections, and contribute to the overall efficiency of healthcare delivery. Additionally, they alleviate the burden on overcrowded hospitals and support healthcare systems by addressing the growing demand for outpatient services.

Get a Free Sample: https://analysissphere.com/ehealth-2-0-market/

Global Ambulatory Surgery Centers Market: Top Companies

1. Surgery Partners, Inc.

- Specialization: Multi-specialty surgical services, including orthopedics, ophthalmology, and pain management.

- Key Focus Areas: Strategic acquisitions, partnerships, and expanding the network of ASCs.

- Notable Features: Advanced surgical technologies and patient-centric care.

- 2024 Revenue (Approx.): $2.8 billion.

- Market Share (Approx.): 8%.

- Global Presence: Predominantly in the United States, with plans for international expansion.

2. Envision Healthcare Corporation

- Specialization: Emergency medicine, anesthesia services, and surgery centers.

- Key Focus Areas: Integration of telemedicine and digital health solutions.

- Notable Features: Comprehensive network of ASCs and robust physician partnerships.

- 2024 Revenue (Approx.): $4.5 billion.

- Market Share (Approx.): 12%.

- Global Presence: United States-focused, with regional collaborations.

3. United Surgical Partners International, Inc. (USPI)

- Specialization: Multi-specialty and single-specialty surgical procedures.

- Key Focus Areas: Joint ventures with physicians and healthcare systems.

- Notable Features: Strong emphasis on patient outcomes and operational efficiency.

- 2024 Revenue (Approx.): $3.7 billion.

- Market Share (Approx.): 10%.

- Global Presence: Extensive presence in North America.

4. HCA Healthcare, Inc.

- Specialization: Acute care, surgery centers, and outpatient facilities.

- Key Focus Areas: Innovation in surgical technologies and expanding outpatient care services.

- Notable Features: Integration of electronic health records (EHR) and AI-driven analytics.

- 2024 Revenue (Approx.): $60 billion (overall).

- Market Share (Approx.): 5% (specific to ASCs).

- Global Presence: United States and select international markets.

5. Ambulatory Surgical Centers of America, Inc.

- Specialization: Development and management of surgery centers.

- Key Focus Areas: Customized ASC solutions and physician ownership models.

- Notable Features: Tailored services to meet community healthcare needs.

- 2024 Revenue (Approx.): $1.2 billion.

- Market Share (Approx.): 3%.

- Global Presence: United States-focused.

Leading Trends and Their Impact

1. Technological Advancements

The adoption of robotic-assisted surgeries, AI-driven diagnostics, and advanced imaging technologies is transforming the ASC landscape. These innovations enhance precision, reduce recovery times, and improve patient outcomes.

2. Value-Based Care Models

ASCs are aligning with value-based care principles by focusing on cost-effective and patient-centered approaches. This trend is driving higher patient satisfaction and improved financial performance.

3. Shift Toward Minimally Invasive Procedures

The growing preference for minimally invasive surgeries has increased the demand for ASCs. These procedures involve smaller incisions, reduced pain, and shorter recovery periods, making them ideal for outpatient settings.

4. Telemedicine Integration

Telehealth services are being incorporated into ASC operations, enabling pre-operative consultations and post-operative follow-ups. This integration improves accessibility and convenience for patients.

5. Expansion in Emerging Markets

Rising healthcare infrastructure investments and favorable government policies in emerging markets are creating growth opportunities for ASCs.

Successful Examples of Ambulatory Surgery Centers

1. Shouldice Hospital, Canada

- Specializes in hernia repairs with a unique patient-focused approach.

- Known for its high success rates and efficient operations.

2. Parkway Shenton, Singapore

- Offers a wide range of outpatient surgical services.

- Focuses on advanced technologies and personalized patient care.

3. The Advanced Surgery Center of Beverly Hills, USA

- Specializes in cosmetic and reconstructive surgeries.

- Utilizes cutting-edge surgical equipment and a patient-first philosophy.

4. Spire Healthcare, United Kingdom

- Provides multi-specialty outpatient services.

- Recognized for its quality care and innovative practices.

Regional Analysis: Government Initiatives and Policies Shaping the Market

1. North America

- Government Initiatives: Medicare reimbursements for ASCs and tax incentives for outpatient care facilities.

- Market Insights: The United States leads in ASC adoption due to advanced healthcare infrastructure and high outpatient surgery volumes.

2. Europe

- Government Initiatives: National healthcare programs emphasizing cost efficiency and reduced hospital stays.

- Market Insights: Countries like Germany and the UK are investing in ASCs to address growing healthcare demands.

3. Asia-Pacific

- Government Initiatives: Public-private partnerships and investments in healthcare infrastructure.

- Market Insights: Rapid growth in countries like India and China due to rising healthcare awareness and medical tourism.

4. Latin America

- Government Initiatives: Health reforms promoting outpatient care.

- Market Insights: Emerging market with significant potential, driven by urbanization and rising healthcare expenditures.

5. Middle East & Africa

- Government Initiatives: Strategic investments in healthcare and medical tourism.

- Market Insights: Growth is fueled by expanding healthcare access and modernization efforts.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: eHealth 2.0 Market Growth, Trends, and Global Impact from 2024 to 2034