Alternative Fuels Market Size

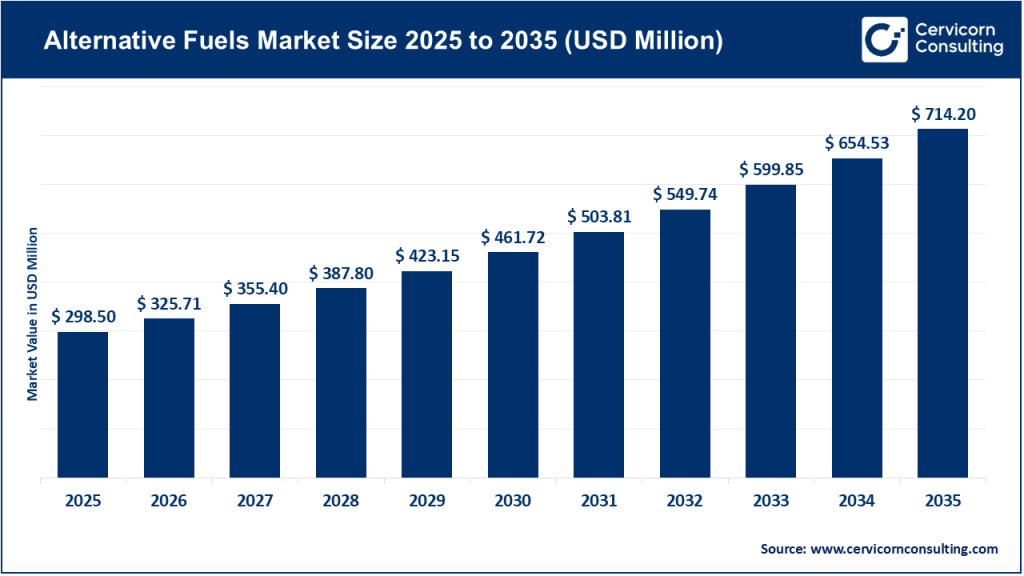

The global alternative fuels market size was worth USD 298.50 million in 2025 and is anticipated to expand to around USD 714.20 million by 2035, registering a compound annual growth rate (CAGR) of 9.20% from 2026 to 2035.

What Is the Alternative Fuels Market?

The alternative fuels market refers to the global industry segment involved in the production, distribution, and consumption of fuels that serve as substitutes for traditional fossil fuels like petroleum, coal, and natural gas. These alternative fuels include biofuels (e.g., ethanol, biodiesel), hydrogen, natural gas (especially renewable natural gas), synthetic e‑fuels, and other low‑carbon energy carriers. Unlike conventional fuels, these alternatives are designed to emit fewer greenhouse gases, reduce air pollution, and decrease dependence on finite fossil fuel reserves. They are increasingly used in transportation, power generation, industrial applications, and even residential settings. The industry encompasses everything from feedstock cultivation and fuel processing to infrastructure development and end‑user applications.

Why Is the Alternative Fuels Market Important?

The alternative fuels market is crucial for several reasons. First, environmental sustainability: transportation and industrial sectors are among the largest emitters of carbon dioxide and other pollutants. Alternative fuels help reduce emissions significantly, supporting global climate goals such as the Paris Agreement. Second, energy security: by diversifying energy sources, countries can reduce reliance on imported fossil fuels and shield themselves from geopolitical supply shocks. Third, economic resilience: investments in alternative fuels stimulate job creation in renewable energy sectors, boost rural economies (especially in biofuel feedstock farming), and foster innovation in fuel technologies.

Finally, policy alignment: nations around the world are implementing stringent emissions standards, renewable energy mandates, and tax incentives to accelerate clean energy adoption, making alternative fuels a central pillar of future energy systems.

Company Profiles in the Alternative Fuels Market

Below, we profile several key players shaping the alternative fuels sector today — covering specialization, focus areas, notable features, 2024 revenue indicators, market share, and global presence.

1. Valero Energy Corporation

Valero Energy Corporation is an established American energy company that has strategically expanded into alternative fuels, particularly renewable diesel, ethanol, and sustainable aviation fuel (SAF) production.

Specialization:

- Renewable diesel production through its joint venture Diamond Green Diesel

- Ethanol manufacturing across multiple plants

- SAF development and distribution

Key Focus Areas:

- Scaling biofuel and renewable diesel capacity

- Leveraging refining expertise to support low‑carbon fuel production

- Enhancing supply chain integration for alternative fuels

Notable Features:

- Operates 12 ethanol plants with ~1.6 billion gallons of annual capacity and 2 renewable diesel plants producing ~1.2 billion gallons per year

- Renewable diesel sales volumes averaging over 3.4 million gallons per day in recent reporting periods

2024 Revenue:

Valero reported ~$129.9 billion in revenues for 2024, although this figure encompasses its entire energy portfolio, including conventional fuels.

Market Share:

Valero is one of the larger contributors in the biofuel segment globally, with its ethanol and renewable diesel operations forming part of a ~5% market share among core alternative fuel producers in 2024.

Global Presence:

Primarily active in North America with distribution reach extending into international markets through exports and SAF partnerships.

2. Archer Daniels Midland Company (ADM)

Archer Daniels Midland Company is a major global agricultural processor and commodities trader with a significant footprint in biofuels.

Specialization:

- Production and trading of ethanol and biodiesel feedstocks

- Bioenergy and sustainable fuel processing from agricultural commodities

Key Focus Areas:

- Scaling ethanol blending and renewable fuel supply operations

- Advancing sustainable aviation fuel (SAF) capabilities projected to commercialize by 2026

Notable Features:

- Extensive grain and oilseed processing infrastructure supports biofuel production

- Integration across agricultural supply chains affords ADM competitive positioning

2024 Revenue:

ADM reported revenues of ~$77.3 billion for 2024 across its diversified business segments.

Market Share:

While ADM’s primary revenue comes from food and agribusiness, its biofuels operations contribute to the broader alternative fuels segment, reinforced by international ethanol markets.

Global Presence:

Headquartered in Chicago, United States, with operations spanning the Americas, Europe, and global agricultural markets.

3. Renewable Energy Group (REG)

Renewable Energy Group is a U.S.-based company specializing in renewable fuels.

Specialization:

- Production of biodiesel and renewable diesel from waste fats, oils, and greases

Key Focus Areas:

- Expanding refinery capacity for renewable fuels

- Advancing low‑carbon fuel supply for transportation and industrial markets

Notable Features:

- Recognized as one of the core manufacturers in the global alternative fuel market alongside Valero and ADM

2024 Revenue & Market Share:

As part of Chevron, specific alternative fuel revenue figures are consolidated, but REG contributed to the approximate 5% market share captured by top producers in 2024.

Global Presence:

Regional primarily in North America with export pathways to key overseas markets.

4. Green Plains Inc.

Green Plains Inc. is a biorefining company focused on ethanol and other biofuel production in North America.

Specialization:

- Low‑carbon ethanol and renewable biofuel production

- Sustainable agricultural ingredient processing

Key Focus Areas:

- Ethanol manufacturing using corn and other crop feedstocks

- Carbon capture and low‑carbon fuel initiatives

Notable Features:

- One of North America’s largest ethanol producers with significant fermentation and processing capacity

2024/2025 Revenue:

Recent reports reflect varying quarterly performance, with total annual revenue fluctuating due to commodity markets. For instance, Q3 2025 revenue was reported around $508.5 million, with $1.66 billion year-to-date prior to year end.

Market Share:

As a major ethanol producer, Green Plains holds a meaningful position within the North American biofuel segment.

Global Presence:

Primarily U.S.-focused, but ethanol exports extend to global markets depending on trade conditions.

5. HIF Global

HIF Global is an innovative player focused on e-fuels — synthetic fuels made from renewable power and captured carbon.

Specialization:

- Electrofuels that can power cars, ships, and planes with no engine modification

Key Focus Areas:

- Building integrated e‑fuel production facilities

- Scaling green hydrogen and e‑fuel output worldwide

Notable Features:

- Backed by strategic partners including Porsche AG

- Pioneering e‑fuel projects across continents

2024 Revenue:

Financial data for HIF’s revenue is not broadly published, as the company is still in early scaling stages.

Market Share:

Emerging player with innovative technology — market share is currently small but projected to grow as e‑fuel adoption increases.

Global Presence:

Operations and projects in the Americas, Europe, Asia Pacific, and Australia via subsidiary divisions.

Leading Trends and Their Impact

The alternative fuels market is evolving rapidly. Key trends include:

1. Biofuels Expansion:

Biofuels like ethanol and biodiesel remain dominant due to compatibility with existing engines and infrastructure. Biofuels accounted for nearly 40–50% of total alternative fuel revenue in 2024, driven by transportation demand.

2. Sustainable Aviation Fuel (SAF):

With aviation under pressure to decarbonize, SAF production and blending mandates are increasing. Major agribusiness and energy companies are investing heavily in SAF facilities poised for commercialization by the mid‑2020s.

3. Hydrogen and Electrofuels Growth:

Green hydrogen and synthetic e‑fuels represent a rapidly expanding frontier. Electrolyzer deployments and renewable power capacity expansions are underpinning major future growth.

4. Policy and Regulatory Momentum:

Government initiatives — including renewable fuel standards, carbon pricing, and emissions targets — continue to shape investment flows. Over 78 countries offer policy incentives for adoption.

5. Infrastructure Development:

Expansion of hydrogen fueling stations, renewable diesel refineries, and biofuel distribution networks are enhancing accessibility.

Successful Examples of Alternative Fuels Around the World

Brazil’s Ethanol Program:

Brazil has one of the most successful ethanol markets globally, using sugarcane for fuel at scale for decades, significantly reducing oil imports and emissions.

Europe’s Hydrogen Corridors:

EU countries are investing heavily in hydrogen infrastructure and blending facilities, supporting heavy‑duty freight and industrial use cases.

California’s Low Carbon Fuel Standard (LCFS):

California’s LCFS drives alternative fuel adoption by pricing carbon intensity and rewarding low‑carbon fuels like biodiesel, renewable diesel, and hydrogen.

Japan’s Hydrogen Strategy:

Japan’s national plan includes hydrogen fueling stations and fuel cell vehicle incentives to decarbonize mobility and industrial sectors.

Global Regional Analysis: Government Initiatives and Policies Shaping the Market

North America:

The U.S. Renewable Fuel Standard (RFS) mandates increased renewable fuel blending, while state policies like California’s LCFS support low‑carbon fuel adoption. Federal tax credits for clean fuels under the Inflation Reduction Act further stimulate investment.

Europe:

The European Union’s Fit for 55 package and national carbon pricing systems compel fuel decarbonization through mandates and incentives. Pilot projects for hydrogen and biomethane are advancing freight decarbonization.

Asia Pacific:

Asia Pacific leads in market share, propelled by China and India’s environmental policies and renewable energy targets. Several countries are expanding hydrogen and biofuel initiatives in transport and industry.

Latin America:

Brazil continues ethanol leadership, while Argentina and others develop biodiesel markets. Renewable fuel programs foster agricultural value chains for energy.

Middle East & Africa:

Emerging renewable hydrogen hubs (e.g., Saudi Arabia and UAE) target export markets. Policy frameworks are being established to support scalable low‑carbon fuel industries.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Electric Bus Market Growth Drivers, Trends, Key Players and Regional Insights by 2035