Agriculture 4.0 Market Size

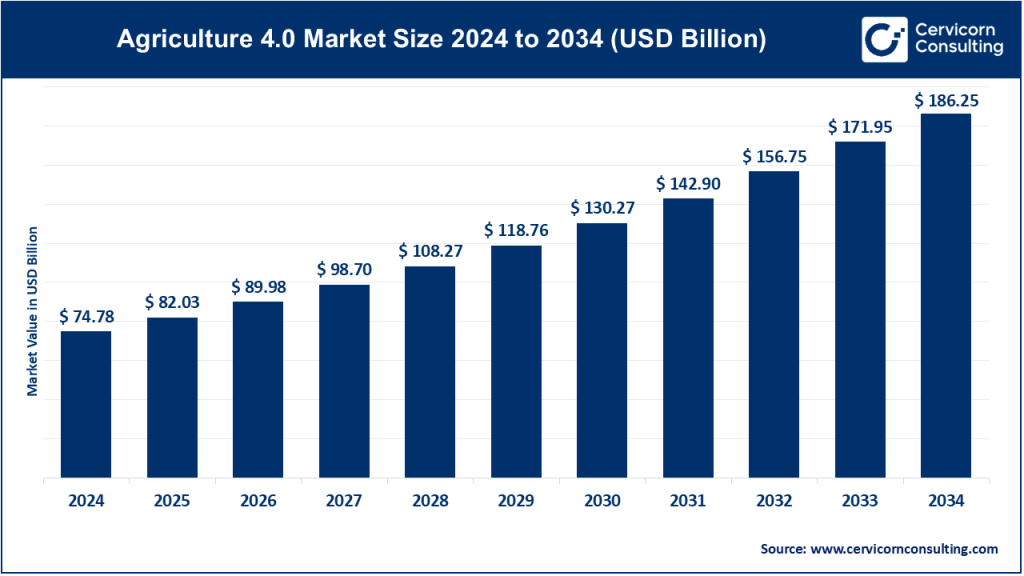

The global agriculture 4.0 market size was worth USD 74.78 billion in 2024 and is anticipated to expand to around USD 186.25 billion by 2034, registering a compound annual growth rate (CAGR) of 9.55% from 2025 to 2034.

Agriculture 4.0 Market Growth Factors

The Agriculture 4.0 market is expanding rapidly due to rising global food demand, increasing pressure on natural resources, and the shift toward environmentally sustainable production systems. Adoption is fueled by declining costs of sensors, connectivity, and computing; rising climate-related risks requiring data-driven farm resilience; and government incentives promoting digitalization, precision agriculture, and sustainable input use. IoT devices, drones, autonomous machinery, and cloud-based decision-support platforms are becoming more accessible, empowering farmers to optimize irrigation, reduce fertilizer overuse, and improve yields.

Private-sector investment, research advances in robotics and AI, and the integration of digital tools with seeds, machinery, and crop protection inputs are accelerating the transition from conventional to digital-driven agriculture worldwide. Together, these forces create a strong growth environment for Agriculture 4.0 technologies across all regions.

What Is the Agriculture 4.0 Market?

Agriculture 4.0 refers to the digital transformation of agriculture through advanced technologies that enhance productivity, sustainability, and profitability. It includes precision farming tools such as GPS-guided tractors, smart irrigation systems, soil and weather sensors, drones, satellite imaging, yield-monitoring systems, AI-powered analytics, robotics, and integrated farm-management platforms. The market comprises hardware, software, data services, automation systems, and value-added services that enable farmers to collect, interpret, and act on field data at unprecedented scale and speed. Ultimately, Agriculture 4.0 represents a shift from intuition-driven to data-driven farming, creating a more predictable, efficient, and sustainable production system.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2407

Why Is Agriculture 4.0 Important?

Agriculture 4.0 is critical because it tackles three major global challenges simultaneously:

-

Feeding a Growing Population: As global demand for food rises, farms must produce more with fewer resources.

-

Reducing Environmental Impact: Precision tools help reduce fertilizer and pesticide overuse, minimize water wastage, and cut greenhouse gas emissions.

-

Improving Farm Resilience: Climate volatility, labor shortages, and supply-chain disruptions require automated, adaptive systems that reduce operational risk.

Through real-time insights and predictive analytics, Agriculture 4.0 helps farmers make better decisions, enhances productivity, ensures sustainable resource use, and supports national food-security strategies. Companies, governments, and policymakers increasingly view digital agriculture as the foundation for future food systems.

Top Companies in the Agriculture 4.0 Market

Below are profiles of the major companies shaping Agriculture 4.0 globally, including their specialization, key focus areas, notable features, 2024 revenue, market presence, and competitive positioning.

1. AGCO Corporation

- Specialization: Agricultural machinery, precision agriculture systems, telematics, crop-input application equipment.

- Key Focus Areas: Smart tractors, advanced combines, precision planting systems, machine connectivity, and analytics.

- Notable Features: Integrates high-accuracy guidance, sensor systems, fleet monitoring, and data platforms into machinery; strong aftermarket and dealer network.

- 2024 Revenue: Approximately $11.7 billion.

- Market Share: Large global farm-equipment OEM with strong positions in Europe, North America, and emerging markets.

- Global Presence: Manufacturing and sales networks across North America, Europe, South America, Asia, and Africa.

2. Bayer AG

- Specialization: Crop protection chemicals, seeds, traits, and digital farming solutions.

- Key Focus Areas: Seed genetics, trait innovation, biological solutions, digital agronomy, and integrated sustainability programs.

- Notable Features: One of the largest global agriscience R&D programs, with digital tools that integrate with seed and crop protection packages.

- 2024 Revenue: Approximately €47 billion in group sales.

- Market Share: One of the world’s largest players in seeds and crop protection.

- Global Presence: Operations across North America, South America, Europe, Asia-Pacific, and Africa.

3. CNH Industrial

- Specialization: Agricultural and construction machinery, precision farming systems, telematics, and automation.

- Key Focus Areas: Autonomous tractors, connected farm machinery, robotics, and next-generation implement technologies.

- Notable Features: Integrates hardware with digital platforms that enhance efficiency, machine uptime, and yield performance.

- 2024 Revenue: Approximately $19.8 billion.

- Market Share: A global leader in agricultural machinery; strong positions in North America, Europe, and Latin America.

- Global Presence: Extensive global distribution, plants, and dealer networks.

4. Corteva Agriscience

- Specialization: Seeds, traits, and crop protection products, with integrated digital advisory systems.

- Key Focus Areas: Advanced seed genetics, biologicals, crop protection chemistry, digital agronomy platforms, and sustainability programs.

- Notable Features: A pure-play agriscience company with strong innovation pipelines in seeds and crop protection.

- 2024 Revenue: Approximately $16.9 billion.

- Market Share: Among the largest global seed and crop-protection companies.

- Global Presence: Operations in more than 100 countries across all major crop-producing regions.

5. CropX Technologies

- Specialization: Soil sensors, digital irrigation management, agronomy analytics, and farm-management software.

- Key Focus Areas: Soil moisture sensing, water-use optimization, IoT-enabled irrigation, crop-health monitoring.

- Notable Features: Known for highly accurate soil-sensor systems integrated with AI algorithms, enabling optimized irrigation and nutrient application.

- 2024 Revenue: Privately held; specific revenue not publicly disclosed.

- Market Share: Recognized leader in soil sensing and irrigation analytics within the Agriculture 4.0 ecosystem.

- Global Presence: Deployments across North America, Europe, Latin America, the Middle East, Australia, and Asia.

Leading Trends in the Agriculture 4.0 Market and Their Impact

1. AI-Driven Decision Support

AI algorithms analyze soil, weather, disease, pest, and yield data to provide actionable recommendations.

Impact: Reduces guesswork and increases yield consistency.

2. Robotics and Autonomous Machinery

Driverless tractors, robotic harvesters, and automated sprayers reduce labor dependency.

Impact: Supports farms facing chronic labor shortages and extends working hours.

3. IoT-Enabled Smart Farms

Connected sensors continuously monitor moisture, nutrient levels, crop health, and equipment performance.

Impact: Enhances efficiency and minimizes input waste.

4. Drone and Satellite-Based Remote Sensing

Captures high-resolution imagery for nutrient mapping, disease detection, and yield forecasting.

Impact: Enables fast, cost-efficient monitoring of large areas.

5. Vertical Integration of Digital and Biological Products

Input suppliers link seeds, chemicals, and biologicals with digital recommendations.

Impact: Strengthens product performance and customer loyalty.

6. Subscription-Based and Outcome-Based Models

Farmers pay for performance (e.g., irrigation savings, yield improvements) rather than for hardware alone.

Impact: Reduces upfront cost and accelerates adoption.

7. Consolidation of Data Platforms

Large agritech players are acquiring smaller digital platforms to offer end-to-end solutions.

Impact: Simplifies adoption and enhances interoperability.

Successful Agriculture 4.0 Examples Around the World

1. Precision Agriculture in the U.S. Midwest

Corn and soybean farms use variable-rate planting, fertilizer management, and drone imagery to optimize yields and reduce input overuse.

Results include substantial fertilizer savings and improved yield performance.

2. Smart Smallholder Farming in India and Kenya

Digital advisory platforms—combined with weather alerts, soil testing, and low-cost sensors—help small farmers improve yields and reduce crop losses.

These programs have proven highly scalable and cost-effective.

3. Automated Greenhouses in the Netherlands

Robotics, climate control systems, and AI-driven nutrient dosing maintain optimal growing conditions.

These greenhouses achieve world-leading productivity with minimal water use.

4. Precision Irrigation in Israel and Australia

Soil sensors integrated with automated drip systems reduce water consumption dramatically.

This has made desert agriculture more productive and sustainable.

Global Regional Analysis and Government Initiatives

North America

The US and Canada lead in mechanization, digital platforms, and AI adoption.

Government initiatives supporting digital agriculture include:

- Climate-Smart Agriculture programs

- Federal precision-agriculture grants

- Subsidies for water-efficient irrigation

North America has some of the world’s highest precision-tech adoption rates due to large commercial farms and strong R&D ecosystems.

Europe

Europe’s Agriculture 4.0 growth is driven by strict environmental regulations and sustainability goals.

Key policies include:

- The EU’s Common Agricultural Policy (CAP)

- Europe’s “Farm to Fork” Strategy

- National subsidies for carbon-efficient farming

These policies require farmers to reduce emissions, improve fertilizer efficiency, and document sustainability performance—accelerating the demand for digital tools.

Latin America

Brazil, Argentina, and Chile are key markets with strong adoption of precision machinery and digital agronomy.

Government programs support:

- Irrigation modernization

- Climate adaptation technologies

Large-scale row-crop producers particularly benefit from drone monitoring, telematics, and precision planting.

Asia-Pacific

A diverse region with high-tech economies (Japan, South Korea, Australia) and rapidly digitizing smallholder markets (India, China, Southeast Asia).

Government initiatives include:

- India’s National Digital Agriculture Mission

- China’s Smart Agriculture Pilot Zones

- Australia’s water-efficiency and AI-farming grants

Asia-Pacific is one of the fastest-growing markets for Agriculture 4.0.

Middle East and Africa

Severe water scarcity drives demand for precision irrigation and soil monitoring.

Governments invest in:

- National food-security programs

- Water-efficient smart farms

- Desert agriculture research

Digital agriculture is often supported by NGOs, public–private partnerships, and international development funds.

How Leading Companies Are Responding

AGCO and CNH Industrial

These machinery giants are embedding GPS guidance, telematics, automation, and predictive maintenance into tractors, combines, and application equipment. Their business models are shifting from machinery-only to machinery+software+services.

Bayer and Corteva

Seed and chemical companies are integrating digital tools into their product ecosystems—helping farmers choose the right hybrids, optimize protection programs, reduce risk, and meet sustainability requirements.

CropX and Other Ag-Tech Scaleups

Sensor and software companies provide highly specialized capabilities such as soil moisture sensing, microclimate modeling, irrigation scheduling, and carbon-tracking. These solutions enhance decision-making and close gaps traditional tools cannot address.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Nuclear Reactors Market Revenue, Global Presence, and Strategic Insights by 2035